7 April 2025

In the current economic climate, businesses are facing numerous challenges, one of which is the rising National Insurance Contributions (NICs). From April 2025, changes will take effect, including an increase in the employer's NIC rate from 13.8% to 15% and a reduction in the secondary threshold from £9,100 to £5,000. www.armstrongwatson.co.uk/news and www.gov.uk/government/publications These changes will have significant repercussions for businesses, particularly in relation to cash flow and payment practices.

The impact of rising NICs on businesses and late payments

Increased pressure on cash flow.

Employers will need to allocate more funds towards these contributions, reducing the amount available for other operational expenses. With liquidity stretched, businesses may delay payments while waiting for cash flow injections from sales or debt financing.

Effect on supply chain

With tighter budgets, businesses may struggle to pay their suppliers and creditors on time, leading to an increase in late payments. This creates a ripple effect, causing financial instability across the supply chain, resulting in delays and financial stress for small suppliers.

Impact on SMEs

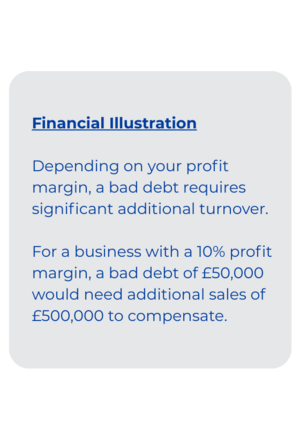

Small and medium-sized enterprises (SMEs) are particularly vulnerable to additional costs, as they often operate on tighter margins. These businesses may struggle to absorb the increased NICs, leading to reduced profit margins. When payments are late, regular customers may seek alternative suppliers, potentially reducing sales.

Potential increases in insolvencies

An increased reliance on credit facilities may lead to higher debt positions on the balance sheet. Businesses with poor cash flow may struggle to meet banking covenants, tax obligations, and supplier payments, increasing the risk of insolvency and non-payment.

Trade Credit insurance: A financial solution to manage late payments and insolvencies

In this challenging and evolving environment, Trade Credit insurance provides a safety net against payment defaults and insolvency. The key benefits include:

- Market Intelligence– Gain valuable insights into customers to make informed decisions when negotiating contracts and agreeing on payment terms. Limiting exposure to high-risk customers enables businesses to focus on profitable, reliable accounts.

- Protect Cash Flow– Preserve working capital and promptly replace cash flow when invoices go unpaid.

- Access to Funding– Businesses with trade credit insurance are viewed more favourably by lenders and financial institutions, improving access to financing at competitive rates. This can be crucial for maintaining operations during periods of financial strain.

- Reduce Bad Debt Reserves– Free up cash reserves allocated for bad debts, allowing businesses to invest in growth, innovation, or expansion opportunities. Additionally, premiums are tax-deductible.

Conclusion:

As businesses navigate the financial pressures of rising NICs, adopting Trade Credit insurance can be a proactive measure to safeguard cash flow, mitigate risks, and ensure financial stability.